UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

☐ | ||

Preliminary Proxy Statement |

☐ | ||

Confidential, |

☒ | ||

Definitive Proxy Statement |

☐ | ||

Definitive Additional Materials |

☐ | ||

Soliciting Material Pursuant to §240.14a-12 |

Commerce Union Bancshares, Inc.

(Name of Registrant as Specified In Itsin its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | ||||

No fee required. | ||||

☐ | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1) | Title of each class of securities to which transaction applies: | |||

| ||||

(2) | Aggregate number of securities to which transaction applies: |

| ||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| ||||

(4) | Proposed maximum aggregate value of transaction: |

| ||||

(5) | Total fee paid: |

☐ | ||||

Fee paid previously with preliminary materials. | ||||

☐ | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: | |||

| ||||

(2) | Form, Schedule or Registration Statement No.: |

| ||||

(3) | Filing Party: |

| ||||

(4) | Date Filed: |

| |

COMMERCE UNION BANCSHARES, INC.

1736 Carothers Parkway, Suite 100

Brentwood, Tennessee 37027

May 14, 2015

April 19, 2017

Dear fellow shareholder:

You are cordially invited to attend the annual meeting of shareholders of Commerce Union Bancshares, Inc. This letter serves as your official notice that we will hold the meeting on Thursday, June 18, 2015,1, 2017, at 5:00 p.m., local time, at the Tennessee Bankers Association, located at 211 Athens Way, Nashville, Tennessee 37228 for the following purposes:

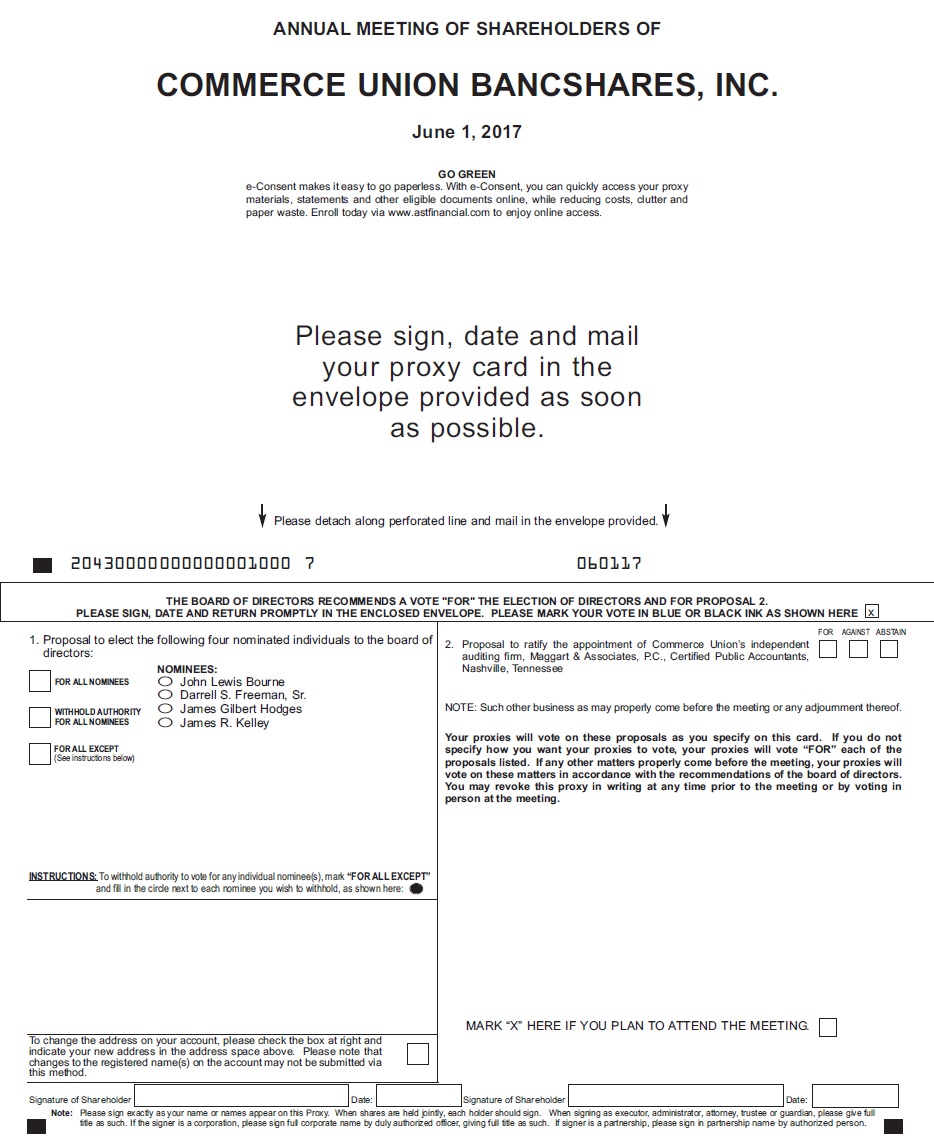

1. | To elect as directors the four nominees named in the accompanying proxy statement; |

2. | To ratify the appointment of Maggart & Associates, P.C. as our independent registered public accountants for our fiscal year ending December 31, |

3. |

| To transact such other business as may properly come before the annual meeting or any adjournment of the meeting. |

This proxy statement is first being mailed to shareholders on or about April 26, 2017.

Your vote is important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote over the internet, as well as by telephone, or by mailing a proxy card. Detailed voting instructions are included on your proxy card. However, if your shares are held in “street name,” you will need to obtain a proxy form from the institution that holds your shares in order to vote at our annual meeting.

By order of the board of directors,

|

| |||

President |

| |||

Chairman and Chief Executive Officer |

COMMERCE UNION BANCSHARES, INC.

1736 Carothers Parkway, Suite 100

Brentwood, Tennessee 37027

May 14, 2015

April 19, 2017

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 18, 2015To Be Held June 1, 2017

General

Our board of directors is soliciting proxies for the 2017 annual meeting of shareholders. This proxy statement is being furnishedcontains important information for you to consider when deciding how to vote on the shareholders of Commerce Union Bancshares, Inc.matters brought before the meeting. We encourage you to read it carefully. We are distributing this proxy statement on or about April 26, 2017. In this proxy statement, the terms “we,” “our,” “ours,” “us,” “Commerce Union” and the “Company” refer to Commerce Union Bancshares, Inc.

The accompanying proxy is solicited on behalf of the board of directors of Commerce Union Bancshares, Inc. for use atterms “Reliant” and “Reliant Bank” refer to our 2015 annual meeting of shareholders. The annual meeting will be held on Thursday, June 18, 2015, at 5:00 p.m., local time, at thewholly owned subsidiary, Reliant Bank, a Tennessee Bankers Association located at 211 Athens Way, Nashville, Tennessee 37228. The meeting is being held to:banking corporation.

We do not know of any business that will be presented for consideration at the Meeting other than the matters described in this proxy statement. This proxy statement is dated May 14, 2015, and is being mailed or otherwise made available to the shareholders of Commerce Union on or about May 20, 2015, along with the form of proxy.

Voting Information

The board set May 13, 2015April 7, 2017 as the record date for the meeting. Shareholders owning shares of our common stock at the close of business on that date are entitled to attend and vote at the meeting, with each share entitled to one vote. There were 7,062,5087,826,450 shares of common stock outstanding on the record date. A majority of the outstanding shares of common stock entitled to vote at the meeting will constitute a quorum. We will count abstentions and broker non-votes, which are described below, in determining whether a quorum exists.

Many of our shareholders hold their shares through a stockbroker, bank, or other nominee rather than directly in their own name. If you hold our shares in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee, who is considered the shareholder of record with respect to those shares, is forwarding these materials to you. As the beneficial owner, you have the right to direct your broker, bank, or other nominee how to vote and are also invited to attend the annual meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the shareholder of record giving you the right to vote the shares. Your broker, bank, or other nominee has enclosed or provided a voting instruction card for you to use to direct your broker, bank, or other nominee how to vote these shares.

If a share is represented for any purpose at the annual meeting by the presence of the registered owner or a person holding a valid proxy for the registered owner, it is deemed to be present for the purpose of establishing a quorum. Therefore, valid proxies which are marked “Abstain” or “Withhold” or as to which no vote is marked, including broker non-votes (which are described below), will be included in determining the number of votes present or represented at the annual meeting.

When you sign the proxy card or submit your vote via the internet, you appoint DeVan D. Ard, Jr. and William R.(Ron) DeBerry as your representatives at the meeting. Messrs. Ard and DeBerry will vote your proxy as you have instructed them on the proxy card. If you submit a proxy but do not specify how you would like it to be voted, Messrs. Ard and DeBerry will

1

vote your proxy for the election to the board of directors of all nominees listed below under “Election of Directors,” for the approval of the equity compensation planDirectors” and for the ratification of the appointment of our independent registered public accountants for the year ending December 31, 2015.2017. We are not aware of any other matters to be considered at the meeting. However, if any other matters come before the meeting, Messrs. DeBerry and Ard will vote your proxy on such matters in accordance with their judgment.

Broker non-votes

A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. The ratification of auditors is a routine matter. The other matters to be addressed at the annual meeting, including the election of directors and the approval of the equity compensation plan are non-routine matters.is not a routine matter.

Voting and quorum requirements at the meeting

In order to have a meeting, it is necessary that a quorum be present. A quorum will be present if a majority of the shares of common stock are represented at the annual meeting in person or by proxy. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will not be counted as having voted either for or against a proposal.

Assuming that a quorum is present:

● | With respect to Proposal No. 1, the directors will be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. This means that the individuals who receive the highest number of votes are selected as directors up to the maximum number of directors to be elected at the meeting. We will not count abstentions, broker non-votes or the failure to return a signed proxy as either for or against a director, so abstentions, broker non-votes and the failure to return a signed proxy have no impact on the election of a director. |

● | With respect to Proposal No. 2, the proposal will be approved if the number of shares of common stock voted in favor of the matter exceeds the number of shares of common stock voted against the matter. If a shareholder submits a proxy but does not specify how he or she would like it to be voted, then the proxy will be voted “FOR” the ratification of the appointment of our independent registered public accountants for the year ending December 31, 2017. We will not count abstentions, broker non-votes or the failure to return a signed proxy as either for or against this proposal, so abstentions, broker non-votes and the failure to return a signed proxy have no impact on the ratification of the appointment of our independent registered public accountants. |

As to any other matter that may be properly brought before the annual meeting, your proxy will be voted as our board of directors may recommend. If our board of directors makes no recommendation, your proxy will be voted as the proxy holders named in your proxy card deem advisable. As of the date of this proxy statement, our board of directors does not know of any other matter that is expected to be presented for consideration at the annual meeting.

You may revoke your proxy and change your vote at any time before the polls close at the meeting. If you are the record holder of the shares, you may do this by (a) signing and delivering another proxy with a later date, or (b) by voting in person at the meeting, or (c) by voting again over the internet or by telephone prior to 5:00 p.m. local time on June 18, 2015.

2

Solicitation of proxies

Solicitations of proxies may be made in person or by mail, telephone, or other means. We are paying for the costs of preparing and mailing the proxy materials and of reimbursing brokers and others for their expenses of forwarding copies of the proxy materials to our shareholders. Our directors, officers, and employees may assist in soliciting proxies but will not receive additional compensation for doing so.

On request, we will provide, without charge, a copy of our Annual Report on Form 10-K for the year ended December 31, 2014,2016, as filed with the SEC (including a list briefly describing the exhibits thereto), to any shareholder.Please contact us at (615) 384-3357,221-2020, or write to J. Daniel Dellinger, our Chief Financial Officer, at 1736 Carothers Parkway, Suite 100, Brentwood, Tennessee 37027,for any such request.

About the

2015 Bank Merger of Commerce Union Bank and Reliant

Effective April 1, 2015, Commerce Union completed the merger of legacy Reliant Bank, a Tennessee corporation (“Legacy ReliantBank”) with and into Commerce Union’s subsidiary bank, Commerce Union Bank, pursuant to an Agreement and Plan of Merger, dated as of April 25, 2014, as amended byBank. At the First Amendment to the Agreement and Plan of Merger, dated as of December 31, 2014, by and among Commerce Union, Commerce Union Bank, and Reliant Bank (the “merger agreement”). At closing of the merger, Reliant Bank merged with and into Commerce Union Bank, with Commerce Union Bank surviving the merger as the surviving corporation. Effective September 24, 2015, Commerce Union Bank changed its name to “Reliant Bank” and is referred to in this proxy statement as “Reliant Bank.”

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees and Vote Required to Elect Nominees

The board of directors currently has 11 members divided into three classes with staggered terms, so that the terms of only approximately one-third of the board membersmembers’ terms expire at each annual meeting. The current terms of the Class I directors will expire at the 20152018 annual meeting of shareholders. The terms of the Class II directors will expire at the 20162019 annual meeting of shareholders, and the terms of the Class III directors will expire at the 2017 annual meeting of shareholders.

Our current directors and their classes are:

Name | Board class | |

Homayoun Aminmadani | Class II Director | |

DeVan D. Ard, Jr. | Class I Director | |

Charles Trimble (Trim) Beasley | Class II Director | |

John Lewis (Buddy) Bourne | Class III | |

William | Class I Director | |

Sharon H. Edwards | Class I Director | |

Farzin Ferdowsi | Class I Director | |

Darrell S. Freeman, Sr. | Class III | |

James Gilbert Hodges | Class III | |

James R. Kelley | Class III | |

Don Richard Sloan | Class II Director |

* Standing for election by the shareholders |

Under the terms of the merger agreement, at the effective time of the merger, the number of directors on the board of directors of Commerce Union was set at 11, of which five were previous members of the Reliant Bank board of directors, five were previous members of the Commerce Union board of directors, and one is an agreed-upon individual who is independent from the combined company under the listing rules of NASDAQ. Of the previous Reliant Bank board members, Mr. Ard and Mr. Ferdowsi were appointed as Class I directors and are standing for election at the annual meeting. Of the

3

former Commerce Union board members, Mr. DeBerry was appointed as a Class I director and is standing for election at the annual meeting. Additionally, in connection with the consummation of the merger, the board appointed Sharon H. Edwards to serve as a Class I director and as the agreed-upon individual who is independent from the combined company.

The board of directors recommends that you elect Mr. Ard, Mr. DeBerry, Mr. Ferdowsi,Messrs. Bourne, Freeman, Hodges, and Ms. EdwardsKelley as Class IIII directors. If a quorum is present, the directors will be elected by a plurality of the votes cast at the meeting. This means that the four nominees receiving the highest number of votes will be elected directors. Abstentions, broker non-votes, and the failure to return a signed proxy will have no effect on the outcome of the vote on this matter. If you submit a proxy but do not specify how you would like it to be voted, Messrs. Ard and DeBerry will vote your proxy to elect Mr. Ard, Mr. DeBerry, Mr. FerdowsiMessrs. Bourne, Freeman, Hodges, and Ms. Edwards.Kelley. If any of these nominees is unable or fails to accept nomination or election (which we do not anticipate), Messrs. Ard and DeBerry will vote instead for a replacement to be recommended by the board of directors, unless you specifically instruct otherwise in the proxy.

Information About theabout Directors

The following table shows for each director of Commerce Union as of May 1, 2015:April 15, 2017: (1) his or her name; (2) his or her age as of May 1, 2015;age; (3) how long he or she has been a director of Commerce Union; (4) his or her position(s) with Commerce Union or Commerce UnionReliant Bank, other than as a director; and (5) his or her principal occupation and business experience for the past five years. Except as otherwise indicated, each director has been engaged in his or her present principal occupation for more than five years.

Name (Age) | Director Since | Positions and Business Experience | ||||

Homayoun Aminmadani |

| Homayoun Aminmadani is a veteran restaurateur with more than 40 years of experience in the YUM! Brands, Inc. as a franchisee of various brands. During these years, Mr. Aminmadani has developed over 150 Pizza Hut restaurants and,

Mr. Aminmadani was a director of Reliant Bank from 2006 to 2015 and was appointed to the Commerce Union board of directors effective April 1, | ||||

DeVan D. Ard, Jr. | 2015 | DeVan Ard, Jr. is the president of Commerce Union and the president and chief executive officer of

Playing an active role in the business and nonprofit community, Mr.

Mr. Ard holds a |

4

| Mr. Ard was a director of Reliant Bank from 2006 to 2015 and was appointed to the Commerce Union board of directors effective April 1, | ||||

Charles Trimble Beasley | 2006 | Trim Beasley is currently the president of Center Star, Inc., a research and development firm specializing in thermal reflective material properties. He graduated from Vanderbilt University with a Bachelor of Engineering degree in 1970 and went on to earn a Master of Business Administration degree from the University of Tennessee in 1975. Mr. Beasley began his business career with Everett Beasley, Inc., serving as company president for 17 years before selling his business interest in 1997. Since that time, he has been involved in numerous small business ventures, Mr. Beasley brings decades of business experience and understanding of community banking to the board of directors of Commerce Union and the board of directors of Reliant Bank, where he serves on the Audit Committee, the Compensation Committee, and the Executive/Loan committee. | ||

John Lewis Bourne | 2006 | Buddy Bourne is a veteran agricultural professional with over 31 years of experience in the tobacco industry. He graduated from Austin Peay State University with a Bachelor of Science degree in Agriculture. Since retiring from his position at Altria Client Services, his most recent employer, Mr. Bourne has continued to pursue his second career as a farmer, producing dark tobacco as well as grain crops. Over the course of his career, Mr. Bourne has been an active member in a variety of professional and community organizations, including the Middle Regional Advisory Council for the University of Tennessee Institute of Agriculture, the Alpha Gamma Rho fraternity, and the Delta Tau Alpha agricultural honor society. Mr. Bourne brings an extensive knowledge of agribusiness as well as a thorough understanding of local farming conditions to the board of directors of Commerce Union and the board of directors of | ||

William Ronald DeBerry | 2006 | Ron DeBerry is currently the chief executive officer of Commerce Union. He received a Bachelor of Business Administration from the University of Mississippi in 1969 and earned a Master of Business of Administration from the University of Tennessee in 1977. After graduating from the University of Mississippi, Mr. DeBerry was commissioned a second lieutenant in the U.S. Army, serving on active duty from 1969 until 1971, including a tour of duty in Vietnam. Mr. DeBerry began his banking career with the former Commerce Union Bank in 1973. He was repeatedly promoted over the following decades, serving in an array of positions with increasing responsibility over strategic banking matters. On August 14, 2006, Mr. DeBerry established the new Commerce Union Mr. DeBerry is an active member of the industry and the communities in which he works. He is a past director of the Tennessee Bankers Association and currently serves as a member of the Association’s Government Relations Committee. He serves as a board member and an executive committee member of the Middle Tennessee Council of Boy Scouts of America. He is a member of the Springfield Kiwanis Club. He is a graduate of Leadership Nashville. He is a former president of PENCIL Foundation and past director of the Robertson County Chamber of Commerce. | ||

Sharon H. Edwards | 2015 | Ms. Edwards is the Finance Director of Willis Towers Watson North America, Finance Director of Willis Towers Watson Corporate Risk & Broking and the Chief Financial Officer of Willis North America, Ms. Edwards has co-chaired the Women at Willis initiative in North America and also serves on the Willis Foundation Board of Directors. In addition to her duties at Willis Towers Watson, Ms. Edwards serves on the Board of Trustees for Pope John Paul II High School. In 2011, Ms. Edwards was selected as one ofBusiness Insurancemagazine’s 2011 “Women to Watch.” Additionally, Ms. Edwards was selected as a finalist for theNashville Business Journal’s2013 “Women of Influence” and a 2016 CABLE Board Walk of Fame honoree. She is a member of Women Corporate Directors, the AICPA, and Tennessee Society of CPA’s. | ||

Farzin Ferdowsi | 2015 | Farzin Ferdowsi has a long history of building successful franchises and serving in leadership roles in the banking and finance community in Middle Tennessee. He is chief executive officer of Brentwood, Tennessee-based Management Resources Company. Formed in 1971, MRCO manages | ||

5

Mr. Ferdowsi’s commitment to community service includes participating on numerous corporate and nonprofit boards. He currently serves as a board member for the Taco Bell Foundation, Boys and Girls Club of Middle Tennessee, and the Community

Mr. Ferdowsi was a director of Reliant Bank from 2006 to 2015 and was appointed to the Commerce Union board of directors effective April 1, | ||||

Darrell S. Freeman, Sr. | 2015 | Darrell S. Freeman Sr. is the chairman of Zycron, Inc., an information technology services and solutions firm he founded in 1991 in Nashville, Tenn. Zycron employs more than

Mr. Freeman’s commitment to the Nashville community is evident through his recently completed, two-term service as immediate past chairman of the Nashville Chamber of Commerce. He is a

| ||

James Gilbert Hodges | 2008 | Jim Hodges is the president of Hodges Group, Inc., a construction company he started in 1990. He currently directs the overall construction management, organization, and operations of all projects and related construction activities for the corporation. Over the course of nearly 25 years, Mr. Hodges has succeeded in expanding his company’s portfolio, offering hundreds of services to his clients and building Hodges Group into a multi-discipline construction company. In addition to his work at Hodges Group, Mr. Hodges has served in leadership positions at various community organizations, including the Chamber of Commerce of Sumner County, Mayor’s Advisory Council, Leadership Middle Tennessee, Portland Planning Commission, and Sumner County Industrial Board. He has also been the recipient of numerous awards, such as Citizen of the Year, Small Business of the Year, the Industrial Excellence Award, and the Governor’s Excellence Award. Additionally, Mr. Hodges served for 12 years on the advisory board for Cumberland Bank. He brings decades of experience in construction and small business management to the board of directors of Commerce Union and the board of directors of | ||

James R. Kelley | 2015 | Jim Kelley is a member of Neal & Harwell, PLC. His practice is focused primarily in the areas of commercial law, bankruptcy, taxation and general corporate matters. He earned his degree from Vanderbilt University and graduated from Emory Law School with distinction receiving a JD and an LLM in Taxation. He has received many professional accolades including recognition as one of Tennessee’s 101 Best Lawyers by Business Tennessee magazine, 100 Super Lawyers in Tennessee by Law & Politics and the publishers of Memphis Magazine, and The Best of the Bar by the Nashville Business Journal, being listed in Best Lawyers in America since 1989 and in Chambers USA and admission as a Fellow in the American College of Bankruptcy and as a Fellow in the Nashville Bar Foundation. | ||

6

Mr. Kelley is active in many civic and charitable

Mr. Kelley was a director of Reliant Bank from 2009 to 2015 and was appointed to the Commerce Union board of directors effective April 1, | ||||

Don Richard Sloan | 2006 | Don Sloan is an independent pharmacist who has owned and operated South Side Drug Company in Springfield, TN, for 40 years. He attended Austin Peay State University and graduated from the University of Tennessee College of Pharmacy in Memphis, TN, in 1972. In addition to his duties at South Side Drug Company, Mr. Sloan is a partial owner of Springfield Drugs and serves on the Robertson County Board of Health and the City of Springfield’s Zoning and Appeals Board. He is also a member of the Tennessee Pharmacist Association and the American Pharmacy Cooperative. As a | ||

Information about Executive Officers

Set forth below is information about our executive officers, other than our directors, Mr. DeBerry, our chief executive officer, and Mr. Ard, our President, who are also directors and are discussed above.

Name (Age) | Officer Since | Positions and Business Experience | ||

J. Dan Dellinger Chief Financial Officer | 2015 | Dan Dellinger is the Chief Financial Officer of Commerce Union. Mr. Dellinger is a veteran community banker with over

Prior to his career in banking, Mr. Dellinger spent 11 years in public accounting. He is a

Mr. Dellinger has participated on several CFO panels for the AICPA and the Tennessee Bankers Association. Mr. Dellinger has also served as an instructor for The Southeastern School of Banking. He served as a director for the Independent Division of the Tennessee Bankers Association for 3 years. He currently serves as a member of the Tennessee Bankers Association’s Government Relations Committee and participates in the Committee’s annual legislators visit to Washington, D.C.

Mr. Dellinger is a member of the Executive Board for the Middle Tennessee Council of the Boy Scouts of America. He also serves on the Finance |

7

|

|

| ||

| Mr. Dellinger received his |

Family Relationships

Mr. DeBerry, our chairman and chief executive officer, is married to Paula DeBerry, our Executive Vice-President, Chief Retail Officer and Sumner County Market Vice President.

Certain Other Related Transactions

Commerce Union

Reliant Bank has had, and expects to have in the future, loans and other banking transactions in the ordinary course of business with its directors (including independent directors) and executive officers of Commerce Union and Reliant Bank, including members of their families or corporations, partnerships or other organizations in which such officers or directors have a controlling interest. These loans are made on substantially the same terms (including interest rates and collateral) as those available at the time for comparable transactions with persons not related to Commerce UnionReliant Bank and did not involve more than the normal risk of collectability or present other unfavorable features.

In addition, Commerce UnionReliant Bank is subject to the provisions of Section 23A of the Federal Reserve Act, which places limits on the amount of loans or extensions of credit to, or investments in, or certain other transactions with, affiliates and on the amount of advances to third parties collateralized by the securities or obligations of affiliates. Commerce UnionReliant Bank is also subject to the provisions of Section 23B of the Federal Reserve Act which, among other things, prohibits an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies.

The aggregate principaldollar amount of loans outstanding to Commerce Union’s directors and executive officers of Reliant Bank and their respective affiliatesCommerce Union was approximately $10.5 million$12,584,408.25 at April 30, 2015.December 31, 2016.

Reliant Mortgage Ventures, LLC is a former subsidiary of Reliant Bank and currently a subsidiary of Commerce Union Bank, which provides mortgage banking services to bank customers. Roger Williams is the president of Reliant Mortgage Ventures, LLC, and Mr. Dellinger is the secretary. This entity was formed as a Tennessee limited liability company in 2011 and has two members, Commerce UnionReliant Bank and VHC Fund 1, LLC, a Tennessee limited liability company. Commerce UnionReliant Bank holds 51% of the governance rights and 30% of the financial rights. VHC Fund 1, LLC holds 49% of the governance rights and 70% of the financial rights. VHC Fund 1, LLC is controlled by an immediate family member of Mr. Ferdowsi.

On April 1, 2010, legacy Reliant Bank (“Reliant”), entered into a Lease Agreement, by and between Reliant and RBC Center II, LLC (now d/b/a RBC Center II, GP) (“RBC Center II”) (the “Operations Lease”) and a Lease Agreement by and between Reliant and RBC Center II (the “Branch Lease”). The Operations Lease and the Branch Lease were assumed by Commerce Union Bank effective April 1, 2015, upon consummation of the merger of legacy Reliant Bank with and into Commerce Union Bank, with Commerce Union Bank surviving the merger and later changing its name to “Reliant Bank.” Certain directors of the Company are limited partners of entities that hold equity interests in RBC Center II. Homayoun Aminmadani and a family member of Farzin Ferdowsi are limited partners of AFF RBC II, LP, which holds a 40% equity interest in RBC Center II. Darrell S. Freeman, Sr. and James R. Kelley are limited partners of KF RBC II, LP, which holds a 17.5% equity interest in RBC Center II. The board members included in this paragraph have disposed of all ownership in the leased properties. The buildings involved were sold to new owners unaffiliated with the Company on February 19, 2015 and January 28, 2016.

Policies on Related Party Transactions

Related party transactions are governed by our Code of Ethics, which applies to all officers, directors and employees. This code covers a wide range of potential activities, including, among others, conflicts of interest, self-dealing, and related party transactions. Waiver of the policies set forth in this code will only be permitted when circumstances warrant. Such waivers for directors and executive officers, or that provide a benefit to a director or executive officer may be made only by the board of directors, as a whole, or the audit committee of the board of directors and must be promptly disclosed as required by applicable law or regulation. Absent such a review and approval process in conformity with the applicable guidelines relating to the particular transaction under consideration, such arrangements are not permitted.

Involvement in Certain Legal Proceedings

In 2008, Messrs. Ferdowsi and Aminmadani each owned a 45% equity interest in (i) American Hospitality Corporation, (ii) Restaurant Management of Carolina, L.P., and (iii) East West Enterprises, LLC. These three entities owned and operated approximately 80 franchised restaurants in the southeastern U.S.United States. In November 2008, one of three lenders to those entities declared a non-monetary default under a credit agreement and subsequently filed a complaint in the U.S. District Court for the Middle District of Tennessee in Nashville seeking the appointment of a receiver for the entities. Messrs. Ferdowsi and Aminmadani, along with the other owners of the entities, all of whom were guarantors of the credit obligations, were also named as defendants in the receivership proceedings. The three entities, in turn, filed petitions for relief under Chapter 11 of the U.S. bankruptcy code in the U.S. Bankruptcy Court for the Middle District of Tennessee in Nashville. In 2009, the three entities and the owners negotiated a consensual Chapter 11 plan of reorganization with the creditors that provided for payment in full of all claims over time. The plan was effective on October 7, 2009. Under the terms of the Chapter 11 plan, Messrs. Ferdowsi and Aminmadani, along with the other owners, reaffirmed their guaranties. In 2010, all of the creditors received payment in cash in full payment of the claims.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE NOMINEES NAMED ABOVE.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to the company with respect to beneficial ownership of the company’s common stock as of May 1, 2015April 7, 2017 for (i) each director and nominee, (ii) each holder of 5.0% or greater of the company’s common stock, (iii) the company’s named executive officers, and (iv) all named executive officers and directors as a group. Unless otherwise indicated, the mailing address for each beneficial owner is care of Commerce Union Bancshares, Inc., 1736 Carothers Parkway, Suite 100, Brentwood, Tennessee 37027.

Name | Number of Commerce Union Shares Owned | Right to Acquire (1) | % of Beneficial Ownership As of May 1, 2015 (2) | Name | Number of Commerce Union Shares Owned | Right to Acquire (1) | % of Beneficial Ownership As of April 7, 2017 (2) | ||||||||||||

Directors and Named Executive Officers | Directors and Named Executive Officers | ||||||||||||||||||

Homayoun Aminmadani (3) | 250,073 | 25,637 | 3.89 | % | |||||||||||||||

DeVan D. Ard, Jr. (4) | 32,170 | 49,043 | 1.14 | % | |||||||||||||||

Homayoun Aminmadani | Homayoun Aminmadani | 275,959 | 0 | 3.53% | |||||||||||||||

DeVan D. Ard, Jr. (3) | DeVan D. Ard, Jr. (3) | 64,520 | 6,107 | * | |||||||||||||||

Charles Trimble (Trim) Beasley | 28,875 | 26,250 | * | Charles Trimble (Trim) Beasley | 26,006 | 0 | * | ||||||||||||

John Lewis (Buddy) Bourne | 12,600 | 10,500 | * | John Lewis (Buddy) Bourne | 16,900 | 0 | * | ||||||||||||

William Ronald (Ron) DeBerry | 47,625 | 78,750 | 1.77 | % | |||||||||||||||

William Ronald (Ron) DeBerry (4) | William Ronald (Ron) DeBerry (4) | 133,087 | 2,000 | 1.73% | |||||||||||||||

J. Daniel Dellinger (5) | 17,163 | 27,064 | * | J. Daniel Dellinger (5) | 40,794 | 7,939 | * | ||||||||||||

Sharon Edwards | 0 | 0 | * | Sharon Edwards | 8,250 | 0 | * | ||||||||||||

Farzin Ferdowsi (6) | 229,345 | 29,127 | 3.64 | % | |||||||||||||||

Darrell S. Freeman, Sr. (7) | 53,690 | 16,361 | * | ||||||||||||||||

Farzin Ferdowsi | Farzin Ferdowsi | 258,722 | 0 | 3.31% | |||||||||||||||

Darrell S. Freeman, Sr. | Darrell S. Freeman, Sr. | 70,301 | 0 | * | |||||||||||||||

James Gilbert Hodges | 5,344.60 | 0 | * | James Gilbert Hodges | 5,595 | 0 | * | ||||||||||||

James R. Kelley | 34,801 | 4,342 | * | James R. Kelley | 39,393 | 0 | * | ||||||||||||

Don Richard Sloan | 14,700 | 10,500 | * | Don Richard Sloan | 25,450 | 0 | * | ||||||||||||

All current directors and named executive officers as a group (12 persons) | 726,387 | 277,574 | 13.68 | % | All current directors and named executive officers as a group (12 persons) | 964,977 | 16,046 | 12.51% | |||||||||||

Less than 1%

(1) | Includes shares that may be acquired within the next 60 days as of |

(2) | For each individual, this percentage is determined by assuming the named person exercises all options which he or she has the right to acquire within 60 days, but that no other persons exercise any options or warrants. For the directors and executive officers as a group and the current and prospective directors and executive officers as a group, these percentages are determined by assuming that each director or executive officer exercises all options which he or she has the right to acquire within 60 days, but that no other persons exercise any options. The calculations are based on |

(3) | 32,360 of these shares are pledged as security for loans. |

(4) | Of these shares, 24,800 are shares held by spouse, Paula DeBerry, and 1,000 vested options are held by spouse, Paula DeBerry. 52,000 of these shares are pledged as security for a loan. |

(5) | Of these shares, 12,625 are held by spouse, Cassie Dellinger, and 537 are held by Mr. Dellinger’s sons and stepson; 2,543 vested options are held by spouse, Cassie Dellinger. 4,000 of these shares are pledged as a security for a loan. |

CORPORATE GOVERNANCE

THE COMPANY’S QUALIFIED RETIREMENT PLAN AND THE BOARD OF DIRECTORS LONG-TERM EQUITY PLANS

Our business

401(k) Plan

Reliant Bank has established the Reliant Bank 401(k) Plan pursuant to which it makes matching and discretionary contributions on behalf of each of the executive officers. Reliant Bank also maintains and pays premiums on behalf of each executive officer under a life insurance plan and provides partial payment of premiums for medical benefits if the executive officer so elects.

Commerce Union Bancshares, Inc. Amended and Restated Stock Option Plan

Background and Purpose.On April 28, 2011, Commerce Union adopted the Commerce Union Bancshares, Inc. Stock Option Plan for directors, organizers and management employees of Commerce Union and Commerce Bank, and on March 10, 2015, the shareholders of Commerce Union approved the Commerce Union Bancshares, Inc. Amended and Restated Stock Option Plan. The stock option plan permits the grant of awards of up to 1,250,000 shares of Commerce Union common stock in the form of stock options. The stock option plan seeks to advance the interests of Commerce Union shareholders by offering management and employees of Commerce Union and Reliant Bank a flexible means of compensation and motivation for outstanding performance and by offering directors and organizers with a grant of equity for furthering the growth and profitability of each entity. The Commerce Union Bancshares, Inc. Amended and Restated Stock Option Plan will continue to remain in effect until March 23, 2021. However, it is managedthe intention of the Company that new grants will not be made under this stock option plan going forward.

Eligibility.Any employee or director of Commerce Union or Reliant Bank that is selected by its employees under the direction and oversight of the board of directors. Board members are kept informeddirectors of Commerce Union’s business through discussions with management, materials providedUnion, is eligible to them by managementreceive grants under the Amended and their participation in board and board committee meetings.

9

Board Composition and Director Independence

AsRestated Stock Option Plan except for a director of April 1, 2015,Commerce Union or Reliant Bank who serves on the board is comprised of eleven directors. The board has determined that a majority of its members are independent as defined by the listing standards of the NASDAQ Stock Market. Specifically, our board of directors has determined thatof an entity other than as provided under Rule 16b-3 of the followingSecurities Exchange Act 1934. Only employees can receive grants of incentive stock options.

Administration.The amended and restated stock option plan is administered by the board of directors are independent: Homayoun Aminmadani, Charles Trimble (Trim) Beasley, John Lewis (Buddy) Bourne, Sharon H. Edwards, Darrell S. Freeman, Sr., James Gilbert Hodges, James R. Kelley, and Don Richard Sloan.

of Commerce Union. The board of directors has four standing committees: the executive committee,power to interpret the audit committee,amended and restated stock option plan and to determine the compensation committee,type and amount of grants, the terms and conditions of the grants and the nominating and governance committee.terms of agreements that will be entered into with the personnel receiving grants. Additionally, the board of directors has the power to amend any outstanding awards of options to the extent it deems appropriate, provided that the individual grantee’s consent is required if the amendment is adverse to the grantee’s interest. The board limits membership onof directors has the audit committee,power to make rules and guidelines for carrying out the compensation committeeamended and restated stock option plan and any interpretation by the board of directors of the terms and provisions regarding the amended and restated stock option plan are final and binding.

Types of Awards.Stock options are rights to purchase a specified number of shares of common stock at a price fixed by the board of directors. Each option must be represented by an award agreement identifying the option as either an “incentive stock option,” within the meaning of Section 422 of the Code, or a “non-qualified stock option,” which does not satisfy the conditions of Section 422 of the Code. The award agreement also must specify the number of shares of common stock that may be issued upon exercise of the options, and set forth the exercise price of the options. The exercise price for options that qualify as incentive stock options may not be less than 100% of the fair market value of the common stock as of the date of grant. The option exercise price may be satisfied in cash or certified or cashier’s check payable to the order of Commerce Union. Options have a maximum term of 10 years from the date of grant. The board of directors has broad discretion to determine the terms and conditions upon which options may be exercised, and the nominatingboard of directors may determine to include additional terms in the award agreements.

Transferability.No options under the amended and corporate governance committeerestated stock option plan are transferable other than by a will or the laws of descent and distribution, as applicable.

Amendment and Termination.The board of directors may amend, alter, suspend or terminate the plan at any time. Any amendment to independent directors as definedthe plan must be approved by the NASDAQ listing standards andstockholders to the extent such approval is required by the terms of the plan, the rules and regulations of the SEC. The standing committees advise the board of directors on policy originationSecurities and plan administrative strategy and assure policy compliance through management reporting from areas under their supervision.

Board Leadership Structure

Currently, the chairman of the board, William Ronald DeBerry, also serves as our chief executive officer, and DeVan D. Ard, Jr. serves as the company’s president. Sharon H. Edwards has been appointed by the board to serve as the lead independent director. The lead independent director provides leadership to and reports to the board of directors focused on enhancing effective corporate governance, provides a source of board leadership complementary to, collaborative with and independent of the leadership of the chairman and chief executive officer, and promotes best practices and high standards of corporate governance.

We believe this leadership structure is most appropriate for us because we believe having the chief executive officer serve as chairman fosters an alignment of various company leadership duties. Additionally, the company believes that having the person most familiar with all aspects of the day to day operations lead the board of directors enhances accountability and effectiveness. Commerce Union does not have a formal policy with respect to the separationExchange Commission, or combination of the offices of chairman of the board and chief executive officer. Rather, the board has the discretion to combine or separate these roles as it deems appropriate from time to time, which provides the board with necessary flexibility to adjust to changed circumstances.

Risk Oversight

Oversight of risk management is a central focus of the board and its committees. The full board regularly receives reports both from committees and from management with respect to the various risks facing the company, and oversees planning and responding to them as appropriate. The audit committee currently has primary responsibility for oversight of financial risk and for oversight of the company’s risk management processes, including those relating to litigation and regulatory compliance. Under its charter, the audit committee is required to discuss the company’s risk assessment and risk management policies and to inquire about any significant risks and exposures and the steps taken to monitor and minimize such risks. The compensation committee is chiefly responsible for compensation-related risks. Under its charter, the compensation committee must discuss and review the key business and other risks the company faces and the relationship of those risks to certain compensation arrangements. Each of these committees receives regular reports from management concerning areas of risk for which the committee has oversight responsibility.

Code of Conduct

The Company has adopted a Code of Conduct, which contains provisions consistent with the SEC’s description of a code of ethics, which applies to its directors, officers and employees, including its principal executive officers, principal financial officer, principal accounting officer, controller and persons performing similar functions. The purpose of the Code of Conduct is, among other things, to provide written standards that are reasonably designed to deter wrongdoing and to: (1) promote honest and ethical conduct; (2) provide full, fair, accurate, timely and understandable disclosure in reports and documents that Commerce Union files with the SEC and other public communications by Commerce Union; (3) assure compliance with applicable governmental laws, rules and regulations; (4) require prompt reporting of any violations of the Code of Conduct; and (5) establish accountability for adherence to the Code of Conduct. Each director is required to read and certify annually that he or she has read, understands and will comply with the Code of Conduct. The Company’s Code of Conduct is available on Commerce Union’s website atwww.commerceunionbank.com in the Investor Relations area.

10

Meetings of the Boards of Directors

In 2014, all of the directors of Commerce Union Bancshares also served as directors of Commerce Union Bank. The Commerce Union Bank board held nine meetings during 2014, and the Commerce Union Bancshares board held four meetings in 2014. All directors attended at least 85% of the aggregate total number of bank and holding company board meetings, and meetings of the bank and holding company board committees on which they served (to the extent held during the period for which the director had been a member of the board(s) or a member of such board committees). The company does not have a policy for director attendance at annual meetings. Each of our directors was present at the 2014 annual shareholders’ meeting.

Audit Committee

The audit committee selects and engages Commerce Union’s independent registered public accounting firm each year. In accordance with its charter, the audit committee, among other things, reviews Commerce Union’s financial statements, the results of internal auditing, financial reporting procedures, and reports of regulatory authorities, and it regularly reports to the board of directors with respect to all significant matters presented at meetings of the audit committee.

The charter of the audit committee is available on our website atwww.commerceunionbank.com in the Investor Relations area. Effective April 1, 2015, the audit committee is comprised of four non-employee directors: Sharon H. Edwards, who serves as chair of the committee, Charles Trimble (Trim) Beasley, John Lewis (Buddy) Bourne, Darrell S. Freeman, Sr., and Homayoun (Homey) Aminmadani, each of whom is “independent” as defined by the NASDAQ listing standards and the rules and regulations of any exchange upon which Commerce Union’s stock is listed. However, no amendment, alteration, suspension or termination of the SEC. During 2014plan may impair the audit committee met three times.rights of any participant, unless mutually agreed in writing by the participant and the Committee.

Nominating and Corporate Governance Committee

The nominating andAdjustments upon Change in Capitalization.In the event of a reorganization, recapitalization, stock split, stock dividend, issuance of securities convertible into stock, combination of shares, merger, consolidation or any other change in the corporate governance committee is responsible for: assisting, advising and making recommendationsstructure of Commerce Union affecting any shares of stock, or a sale by Commerce Union of all or substantially all of its assets, or any distribution to shareholders other than a normal cash dividend, or any assumption or conversion of outstanding grants as a result of an acquisition, the board of directors on corporate governance matters, includingwill make appropriate adjustments in the identification, selection,period of time in which non-qualified stock options may be exercised, the number and recommendationkind of qualified individualsshares authorized, and any adjustments in outstanding grants of options as deemed appropriate to become board members; selecting and recommendingmaintain equivalent value providing that the board approveincentive stock options will continue to meet the director nominees forrequirements of Code Sections 422 and 424.

Change in Control. A change in control of Commerce Union or Reliant Bank will occur upon the annual meetinghappening of shareholders; developing and recommending to the board a set of corporate governance guidelines; developing and recommending a board committee structure and recommending the membership and chairs of committees; overseeing the evaluationsone or more of the board;following events: (i) an acquisition in one or more transactions of 25% or more of the voting stock by any person, or by two or more persons acting as a group other than directly from Commerce Union or Reliant Bank; (ii) an acquisition in one or more transactions of at least 15% but less than 25% of the voting stock by any person, or by two or more persons acting as a group (excluding officers and overseeingdirectors of Reliant Bank), and the succession planning for the chief executive officer. The charter for the nominating and corporate governance committee can be viewed on our website atwww.commerceunionbank.com in the Investor Relations area.

The nominating and corporate governance committee identifies nominees foradoption by the board of directors of a resolution declaring that a change in control of Commerce Union or Reliant Bank has occurred; (iii) a merger, consolidation, reorganization, recapitalization or similar transaction involving the stock of Commerce Union or upon the culmination of which more than 50% of the voting stock of the surviving corporation is held by first evaluatingperson(s) other than former shareholders of Commerce Union or Reliant Bank; and (iv) 25% or more of the current board members willing to continue servingdirectors elected by shareholders of Commerce Union or Reliant Bank are persons who were not listed as directors. Current board members with skills and experience that are relevant to our business and who are willing to continue their service are first considered for re-nomination, balancingnominees in Commerce Union’s or Reliant Bank’s then most recent proxy statement, unless a majority of the value of continuity of service by existing members of the board with that of obtaining new skills, backgrounds and perspective, in light of our developing needs. If a vacancy exists, the committee solicits suggestions for director candidates from a number of sources, which can include other board members, management, and individuals personally known to members of the board.

Pursuant to our guidelines for selecting potential new board members, in selecting and evaluating persons to recommend to the board as nominees for director, the nominating and corporate governance committee strives to select persons who have high integrity and relevant experience and who bring a diverse set of appropriate skills and backgrounds to the board. In this regard, the nominating and corporate governance committee also gives consideration to matching the geographic base of candidates with the geographic coverage of the company, and to diversity on the board that reflects the community that we serve. The nominating and corporate governance committee will also take into account whether a candidate satisfies the criteria for “independence” under NASDAQ’s listing standards. These factors are subject to change from time to time.

The nominating and corporate governance committee also evaluates candidates for nomination to the board of directors who are recommended by shareholders. Shareholders who wish to recommend individuals for consideration by the nominating and corporate governance committee to become nominees for election to the board may do so by submitting a written recommendation to Commerce Union’s Secretary at its executive offices. Submissions must include certain information relating to such person that would indicate such person’s qualification to serve on the board of directors, including that information set forth in Section 3.9 of our bylaws and such other information relating to such person that is required to be

11

disclosed in connection with solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934. The nominating and corporate governance committee will consider recommendations received by a date not later than 120 days before the anniversary date of the mailing of our proxy materials in connection with the prior year’s annual meeting of stockholders for nomination at the next annual meeting. The nominating and corporate governance committee will consider nominations received beyond that date at the annual meeting subsequent to the next annual meeting.

There is no difference in the manner in which the nominating and corporate governance committee evaluates candidates for membership on the board based on whether such candidate is recommended by a shareholder, the nominating and corporate governance committee, a director or by any other source. No submission for board nominees by a shareholder was received by the company with respect to the annual meeting.

Effective April 1, 2015, the nominating and corporate governance committee is comprised of James R. Kelley, the chairman, Homayoun (Homey) Aminmadani, Don Richard Sloan, and John Lewis (Buddy) Bourne. Each member of the committee is independent, as determined under the definition of independence set forth in NASDAQ’s rules and listing standards. During 2014, the nominating and corporate governance committee’s responsibilities were overseen by the entire board, which met nine times.

Compensation Committee

The compensation committee assists, advises and makes recommendations to the board of directors on executive and director compensation matters, including evaluating and recommending to the board compensation and benefit plans for executives and directors of Commerce Union as well as evaluatingor Reliant Bank, excluding the performance of Commerce Union’s executives. The compensation committee also has been delegated responsibility for making certain compensation decisions relating to Commerce Union’s executives and under Commerce Union’s equity compensation plans. The compensation committee solicits the recommendation of our chairman and chief executive officer and our president with respect to compensation determinations concerning the other executive officers of Commerce Union, but does not delegate its authority with respect to compensation matters to any other person.

The compensation committee also may request others, including compensation consultants and legal counsel, to attend meetings or to provide relevant information to assist the committeenew directors, vote that no change in its work. In this connection, the compensation committee has the authority to retain compensation and benefits consultants and legal counsel used to assist the committee in fulfilling its responsibilities.

The charter for the committee can be viewed on our website atwww.commerceunionbank.com in the Investor Relations area.

As of April 1, 2015, the compensation committee is comprised of James (Jim) Gilbert Hodges, chairman, James (Jim) R. Kelley, Charles Trimble (Trim) Beasley, and Darrell S. Freeman, Sr. Each membercontrol occurred by virtue of the committee is independent, as determined under the definition of independence set forth NASDAQ’s rules and listing standards. During 2014, the compensation committee met four times.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation Table and Narrative for Fiscal Year 2014

The following table shows the compensation Commerce Union paid for the years ended December 31, 2013 and 2014 to its president and chief executive officer and our three most highly compensated other executive officers who earned over $100,000 for the year ended 2014 (collectively, the “named executive officers”). Additionally, the table below presents historical compensation information for Reliant’s most highly-compensated officers for the years ended December 31, 2013 and 2014.

COMMERCE UNION | ||||||||||||||||||||||||||||||||||||

Name and principal position | Year | Salary ($) | Bonus (1)($) | Stock awards ($) | Option awards ($) | Non-equity incentive plan compensation ($) | Non-qualified deferred compensation earnings ($) | All other compensation (1)(2)(3)(4)($) | Total ($) | |||||||||||||||||||||||||||

Ron DeBerry, | 2014 | 244,535.72 | 39,375.00 | — | — | — | — | 27,955.72 | 311,866.44 | |||||||||||||||||||||||||||

President and Chief Executive Officer | 2013 | 235,000.07 | — | — | — | — | — | 26,300.50 | 261,300.57 | |||||||||||||||||||||||||||

Rick Murray, | 2014 | 155,689.68 | 21,825.00 | — | — | — | — | 26,872.52 | 204,387.20 | |||||||||||||||||||||||||||

Chief Financial Officer | 2013 | 147,375.00 | 11,750.00 | — | — | — | — | 39,045.72 | 198,170.72 | |||||||||||||||||||||||||||

Scott Bagwell, | 2014 | 170,738.56 | 13,685.00 | — | — | — | — | 28,294.25 | 212,717.81 | |||||||||||||||||||||||||||

Chief Lending Officer | 2013 | 164,696.66 | 14,000.00 | — | — | — | — | 39,821.99 | 218,518.65 | |||||||||||||||||||||||||||

Paula DeBerry, | 2014 | �� | 169,960.76 | 31,122.00 | — | — | — | — | 27,937.51 | 229,020.27 | ||||||||||||||||||||||||||

Chief Retail Officer | 2013 | 137,185.00 | 14,000.00 | — | — | — | — | 26,342.81 | 177,527.81 | |||||||||||||||||||||||||||

12

| RELIANT BANK | ||||||||||||||||||||||||||||||||||||

Name and principal position | Year | Salary ($) | Bonus (5)($) | Stock awards ($) | Option awards ($) | Non-equity incentive plan compensation($) | Non-qualified deferred compensation earnings ($) | All other compensation (5)(6)($) | Total ($) | |||||||||||||||||||||||||||

DeVan D. Ard, Jr., | 2014 | 307,500 | 50,000 | — | — | — | — | 57,035 | 414,535 | |||||||||||||||||||||||||||

President and Chief Executive Officer | 2013 | 300,000 | 215,000 | — | — | — | — | 44,512 | 559,512 | |||||||||||||||||||||||||||

J. Daniel Dellinger, | 2014 | 215,000 | 30,000 | — | — | — | — | 30,000 | 273,561 | |||||||||||||||||||||||||||

Executive Vice President and Chief Operating Officer | 2013 | 210,000 | 42,000 | — | — | — | — | 29,341 | 281,341 | |||||||||||||||||||||||||||

|

13

Outstanding Equity Awards at Fiscal Year-End

The following table shows the number of shares covered by both exercisable and non-exercisable options owned by the individuals who were executives of Commerce Union in 2014 and named in the Summary Compensation Table as of December 31, 2014, as well as the related exercise prices and expiration dates. Options are granted pursuant to Commerce Union’s stock option plan.

Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||||||||||||||||

Ron DeBerry | 78,750 | — | — | $ | 9.52 | 8/23/2016 | — | — | — | — | ||||||||||||||||||||||||||

Rick Murray | 21,000 | $ | 11.67 | 2/28/2018 | — | — | — | — | ||||||||||||||||||||||||||||

Scott Bagwell | 21,000 | — | — | $ | 9.52 | 8/23/2016 | — | — | — | — | ||||||||||||||||||||||||||

Paula DeBerry | 21,000 | — | — | $ | 11.43 | 3/1/2017 | — | — | — | — | ||||||||||||||||||||||||||

New Employment Agreements.

Effective April 1, 2015, upon the consummation of the merger between Commerce Union Bank and Reliant, Mr. DeBerry, Ms. DeBerry, Mr. Bagwell, Mr. Murray, Mr. Ard and Mr. Dellinger entered into new employment agreements with Commerce Union and/or Commerce Union Bank. Eachelection of the new employment agreements contains the following provisions, among others:

Severance on Termination by Employer without Cause. For termination of each executive officer by Commerce Union without cause, Commerce Union and/or Commerce Union Bank, as applicable, shall be required to pay a severance benefit equal to one times each such named executive officer’s annual base salary, payable over 12 months, and reimburse such executive officer for the reasonable cost of premium payments paid by the executive officer to continue then-existing health insurance coverage for 12 months.

14

Severance on Termination by Executive Officer with Cause. For termination for cause by an executive officer resulting from a (A) material reduction in duties or responsibilities, (B) a material reduction in such named executive officer’s salary, or (C)directors. If a change in control occurs due to any of the location of employment outside of a 75 mile radius from such named executive officer primary office, listed events, the outstanding options under this plan shall continue to vest in accordance with the vesting schedule set forth in the option holder’s stock option agreement and continue to be exercised in accordance with terms set forth in the option holder’s stock option agreement.

Commerce Union or Commerce Union Bank, as applicable, shall be required to pay a severance benefit equal to one times the executive officer’s annual base salary, payable over 12 months, and reimburse the executive officer for the reasonable cost of premium payments paid by the executive officer to continue then-existing health insurance coverage for 12 months.

Severance on Change of Control. If within 12 months following any change of control such named executive officer is terminated by Commerce Union and/or Commerce Union Bank (or their successor(s)), as applicable, without cause or the executive officer terminates for cause resulting from a (A) material reduction in duties or responsibilities, (B) a material reduction in the executive officer’s salary, or (C) a change in the location of employment outside of a 75-mile radius from the executive officer’s primary office, the executive officer shall receive as liquidated damages a severance payment equal to one times the executive officer’s annual base salary in one lump sum payment. Additionally, Commerce Union shall reimburse such named executive officer for the reasonable cost of premium payments paid by such named executive officer to continue then-existing health insurance coverage for 12 months.

DIRECTOR COMPENSATION

During the year ended December 31, 2014, each director of Commerce Union Bank received a retainer in the amount of $6,000 and fees of $150 for attendance at each board meeting and $300 for attendance at each committee meeting. The chairman of Commerce Union Bank’s board of directors and the chairman of the board’s audit committee received additional retainers in the amount of $1,500. Mr. DeBerry, as an employee of Commerce Union, did not receive any board fee. He is not listed in the table below because his compensation as a named executive officer is described above. The following is a summary of the compensation paid to directors for 2014.Bancshares, Inc. 2015 Equity Incentive Plan

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Charles Trimble Beasley | 17,525 | — | — | — | — | — | 17,525 | |||||||||||||||||||||

Jane Ellis Bellar * | 12,150 | — | — | — | — | — | 12,150 | |||||||||||||||||||||

John Lewis Bourne | 12,975 | — | — | — | — | — | 12,975 | |||||||||||||||||||||

James Gilbert Hodges | 15,375 | — | — | — | — | — | 15,375 | |||||||||||||||||||||

Gwendolous Verdella Martin * | 9,200 | — | — | — | — | — | 9,200 | |||||||||||||||||||||

Nancy Jo Martin * | 9,675 | — | — | — | — | — | 9,675 | |||||||||||||||||||||

Leland Gray Scott, Jr.* | 10,925 | — | — | — | — | — | 10,925 | |||||||||||||||||||||

Don Richard Sloan | 13,350 | — | — | — | — | — | 13,350 | |||||||||||||||||||||

Marvin Leroy Smith* | 10,650 | — | — | — | — | — | 10,650 | |||||||||||||||||||||

William Robert McKinney, Jr.* | 13,875 | — | — | — | — | — | 13,875 | |||||||||||||||||||||

2015 Director Compensation

General.On April 23, 2015, the board of directors adopted, a new compensation structure forand the board of directors of the post-merger organization. Under the new compensation structure, non-employee board members will receive an annual retainer of $12,000 and $1,000 for every board meeting attended in excess of six meetings per year. Additionally, each voting member of the nominating and corporate governance committee will receive an annual retainer of $4,000, each voting member of the

15

audit committee will receive an annual retainer of $12,000, and each voting member of the compensation committee will receive an annual retainer of $4,000 for his or her committee service. Non-employee members of the executive committee will receive $500 for each meeting attended.

Other Compensation Arrangements

As of the effective time of the merger between Commerce Union Bank and Reliant Bank, Jane Ellis Bellar, Gwendolous Verdella Martin, Nancy Jo Martin, William Robert McKinney, Jr., Leland Gray Scott, and Marvin Leroy Smith, III resigned from the board of directors of Commerce Union. Additionally, as of the effective time of the merger, Mmes. Bellar, G. Martin, and N. Martin and Mr. Scott will also resign from the board of directors of Commerce Union Bank. In connection with their resignations from the board of directors of both Commerce Union and Commerce Union Bank, each of Mmes. Bellar, G. Martin, and N. Martin and Mr. Scott entered into an agreement with Commerce Union and Commerce Union Bank. Each such agreement provides that Commerce Union or Commerce Union Bank will pay the resigning director a severance payment of $10,000. Additionally, pursuant to such agreements, these individuals have agreed that, for a period of 24 months, they shall refrain from, among other things, joining the board of directors or being employed by any other regulated financial institution, working with any individual or group of individuals in connection with organizing another financial institution that would compete with Commerce Union Bank, soliciting any employees of Commerce Union Bank to leave Commerce Union Bank, encouraging customers of Commerce Union Bank to move their business to any other financial institution, disclosing any confidential or proprietary information of or regarding Commerce Union or Commerce Union Bank. Pursuant to such agreements, each director also releases Commerce Union and Commerce Union Bank from any and all claims that the director has or any time had against Commerce Union or Commerce Union Bank.

Certain Relationships and Related Transactions

We make loans and enter into other transactions in the ordinary course of business with our directors and officers and their affiliates. It is our policy that these loans and other transactions substantially be on the same terms (including price or interest rates and collateral) as those prevailingshareholders later approved at the time for comparable transactions with unrelated parties. We do not expect these transactions to involve more than the normal risk of collectability nor present other unfavorable features to us. Loans to individual directors and officers must also comply with our lending policies and statutory lending limits, and directors with a personal interest in any loan application are excluded from the consideration of the loan application. Our policy is that all of our transactions with our affiliates will be on terms no less favorable to us than could be obtained from an unaffiliated third party and will be approved by a majority of disinterested directors or by our audit committee.

Section 16(a) Beneficial Ownership Reporting Compliance

On May 13, 2015 we filed a Form 8-A to register our common stock under Section 12(b) of the Securities Exchange Act of 1934, in connection with our application to list on the NASDAQ Capital Market. At that time, our directors and executive officers became subject to Section 16(a) of the Securities Exchange Act of 1934 to report periodically their ownership of our common stock and any changes in ownership to the SEC. We believe that all such reports for these persons were filed in a timely fashion since that time.

PROPOSAL TWO

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The audit committee of our board of directors has selected Maggart & Associates, P.C. as independent registered public accountants to audit our consolidated financial statements for the fiscal year ending December 31, 2015. Maggart & Associates, P.C. has served as our independent registered public accountants since their appointment in 2006. A representative of Maggart & Associates, P.C. is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

16

Audit and Non-Audit Fees

The following table presents the aggregate fees billed to Commerce Union for professional services rendered by Maggart & Associates for the fiscal years ended December 31, 2013 and December 31, 2014:

Services | 2013 | 2014 | ||||||

Audit Fees | $ | 43,175 | $ | 43,430 | ||||

Audit Related Fees | — | — | ||||||

Tax Fees (1) | 4,975 | 5,923 | ||||||

All Other Fees (2) | — | $ | 253,858 | |||||

The charter of the audit committee provides that the duties and responsibilities of the audit committee include the pre-approval of all services that may be provided to Commerce Union by the independent accountants whether or not related to the audit. In fiscal years 2013 and 2014, these fees described above were approved by the audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF MAGGART & ASSOCIATES, P.C. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR OUR FISCAL YEAR ENDING DECEMBER 31, 2015.

PROPOSAL THREE

APPROVAL OF THE COMMERCE UNION BANCSHARES, INC. 2015 EQUITY INCENTIVE PLAN

General

On April 23, 2015, the board of directors adopted, subject to approval by Commerce Union’s shareholders, the Commerce Union Bancshares, Inc. 2015 Equity Incentive Plan (the “2015 Plan”). The purpose of the 2015 Plan is to promote the company’s interests by attracting and retaining employees through performance-related incentives to achieve long-range performance goals, enabling employees to participate in the financial success of the company, encouraging ownership of company stock by employees, and linking employees’ compensation to the long-term interests of the company and its shareholders. Additionally, the 2015 Plan provides for compensation for directors of Commerce Union and its subsidiaries for their service as members of the various boards of directors through grants of non-qualified options and/or restricted stock. The 2015 Plan provides for compensation through incentive stock options, non-qualified stock options, restricted stock grants, and performance-based cash and equity awards.

The 2015 Plan provides for the issuance of options to purchase and awards of up to 900,000 shares of Commerce Union’s common stock. To date, no new grants have been made under the 2015 Plan. The Commerce Union Bancshares, Inc. Amended and Restated Stock Option Plan (the “stock option plan”) will continue to remain in effect until March 23, 2021. The stock option plan permits the grant of awards of up to 1,250,000 shares of Commerce Union common stock in the form of stock options. The stock option plan seeks to advance the interests of Commerce Union shareholders by offering management and employees of Commerce Union and Commerce Union Bank a flexible means of compensation and motivation for outstanding performance and by offering directors and organizers with a grant of equity for furthering the growth and profitability of each entity.

The board believes it is advisable for the shareholders to approve the adoption of the 2015 Plan to continue to have options available to encourage directors, officers and key employees to remain with Commerce Union and Commerce Union Bank and to attract new, qualified officers, employees and directors in today’s competitive market.

17

Summary of the 2015 Plan

The following description of the 2015 Plan is intended to highlight and summarize the principal terms of the 2015 Plan, and is qualified in its entirety by the text of the 2015 Plan. The full text of the 2015 Plan is available asTermAppendix A provided herewith.

Plan Term.. The 2015 Plan’s term will commence effectivecommenced upon theshareholder approval by a majority of the shares of common stock represented and voting at the 2015 annual meeting. Assuming that the 2015 Plan is approved by Commerce Union’s shareholders on June 18, 2015, the term will commenceshareholder meeting held on June 18, 2015, and will terminate on June 18, 2025 (subject to early termination as described herein).

Administration. The 2015 Plan will beis administered by a committee of the board, which the board has designated toas the compensation committee. Subject to the express provisions of the 2015 Plan, the compensation committee is authorized to construe and interpret the 2015 Plan, and make all the determinations necessary or advisable for administration of the 2015 Plan.

Eligible Participants.Participants. The 2015 Plan provides that all directors and employees of Commerce Union, its affiliated companies, and subsidiaries are eligible to receive grants of stock options, restricted stock, and performance-based cash and equity awards. Subject to the certain limitations, the compensation committee is empowered to determine which eligible participants, if any, should receive options, the number of shares subject to each option, and the terms and provisions of the option agreements.

Shares Subject to the 2015 Plan.Plan. The 2015 Plan provides for the issuance of options to purchase and awards of up to 900,000 shares of Commerce Union’s common stock are covered by the 2015 Plan, which constitutes 12.74% of the shares outstanding as of May 1, 2015.stock. Options will be granted at no less than the fair market value of the common stock as of the date of grant.

Incentive and Non-Qualified Stock Options.Options. The 2015 Plan provides for the grant of both incentive stock options and non-qualified options. Incentive stock options are available only to persons who are employees of Commerce Union or its subsidiaries, and are subject to limitations imposed by applicable sections of the Internal Revenue Code of 1986, as amended (the “Code”), including a $100,000 limit on the aggregate fair market value of shares of common stock with respect to which incentive stock options are exercisable for the first time by an optionee during any calendar year (under the 2015 Plan and all other “incentive stock option” plans of Commerce Union). Any options granted under the 2015 Plan which do not meet the limitations for incentive stock options, or which are otherwise not deemed to be incentive stock options, shall be deemed “non-qualified”. Subject to the foregoing and other limitations set forth in the 2015 Plan, the exercise price, permissible time or times of exercise, and the remaining terms pertaining to any option are determined by the compensation committee; however, the per share exercise price under any option may not be less than 100% of the fair market value of the common stock on the date of grant of the option.

Restricted Stock Grants. The 2015 Plan provides that the compensation committee may grant restricted stock to employees or directors. Restricted stock grants shall consist of shares of common stock granted to a participant, subject to certain restrictions against disposition and certain obligations to forfeit such shares to the company.